Florida Home Insurance Crisis: Understanding the Impact on Real Estate

Welcome back to LIV South Florida, your go-to source for everything about life in the Sunshine State. Today's topic is crucial: Florida's home insurance crisis. This issue is shaking up the real estate market and impacting homeowners, buyers, and investors across South Florida. With skyrocketing premiums, policy cancellations, and limited options, understanding this crisis is essential for anyone considering moving to or investing in Florida. Let's break down how this crisis began, why it's worsening, and what it means for you.

Table of Contents

- Why Are Floridians Dropping Insurance?

- How Did We Get Here?

- The Storm That Changed Everything

- Fraud & Litigation: The Perfect Storm For Insurers

- Roof Age and Hurricane Risk

- The Creation of Citizens Insurance

- Legislative Reforms: Will They Work?

- What Can You Do Right Now?

- Why Does This Matter For Buyers and Sellers?

- Final Thoughts

- FAQ

Why Are Floridians Dropping Insurance?

A staggering 15 to 18% of Floridians have dropped their homeowners insurance, which is almost double the national average. The primary reason? Home insurance in Florida has become incredibly expensive. Back in 2019, the average annual premium was around $1,800, but now premiums range from $6,000 to $9,000 a year, representing a shocking 400% increase over just five years. This year alone, rates have jumped 42%, and with recent hurricanes, they are expected to rise even further.

Many homeowners, especially retirees and seniors, simply can't keep up with these soaring rates and are opting out of coverage. This crisis is not just affecting homeowners; real estate investors are rethinking their plans because the math no longer works with such high insurance costs. It has become nearly impossible to make profitable deals in certain areas.

How Did We Get Here?

These skyrocketing insurance rates are making it nearly impossible to invest in real estate in certain areas. In states like Texas, Florida, and other Gulf States, the figures simply don’t add up, leading many to face tough decisions. For residents, the situation isn't much better. Many homeowners are forced to go without insurance because they simply can't afford it. This challenge escalates for those with mortgages, as they are required to maintain coverage.

Conversely, homeowners who own their properties outright may consider taking the risk. For real estate investors, this scenario raises red flags, as the rising insurance costs are significantly impacting the market. The spike in rates has been staggering, showing no signs of slowing down. One major factor is the operational model of insurance companies; rather than absorbing losses directly, they raise premiums the following year to recover what they’ve paid out.

Consequently, as rates remain between $6,000 and $9,000, they are expected to climb even higher after recent hurricanes. Who bears the cost of this turmoil? Whether you live in Florida or not, chances are you're feeling the impact. Insurance companies are distributing the financial burden from high-risk areas like the Gulf Coast, California, Texas, and even Hawaii across the country.

A well-known provider like Allstate, GEICO, or StateFarm is not immune; they balance losses nationwide. When these companies face heavy claims in Florida, they often offset those losses by raising premiums everywhere else. Many major insurers have completely withdrawn from the Florida market, making it clear that this crisis extends beyond state lines, but it is Floridians who are feeling the brunt of it. As we consider the future of Florida's real estate market, it’s crucial to evaluate how residents and investors will navigate this increasingly challenging landscape.

The Storm That Changed Everything

Hurricane Andrew, which struck South Florida in 1992 is often identified as a pivotal moment in the state's insurance history. This Category 5 hurricane wreaked havoc, destroying tens of thousands of homes and leading to more than 650,000 insurance claims that totaled around $15.5 billion in payouts at the time—equivalent to approximately $32 billion today. The scale of destruction caught major insurance companies off guard, prompting many, including StateFarm, Allstate, Travelers, and Prudential to pull out of Florida or cancel numerous policies. This exodus left homeowners with limited options and plunged the insurance market into chaos.

Hurricane Andrew exposed the severe underestimation of Florida's vulnerability to hurricanes, leading to significant changes in the insurance landscape. As a direct response, the industry adopted new practices, including hurricane deductibles and stricter building codes, to better mitigate risks associated with insuring properties in high-risk areas. Despite these efforts, the ongoing issues of fraud and rising claims costs, coupled with new threats like tornadoes, have further strained the market, making affordable insurance increasingly elusive for many Floridians.

Fraud & Litigation: The Perfect Storm For Insurers

Fast forward to today, Florida's insurance market is more chaotic than ever, with one of the biggest issues being fraud, especially related to roofing claims. Florida accounts for 9% of the nation's home insurance claims, but shockingly, it also accounts for 79% of the nation's home insurance lawsuits. Many of these lawsuits are suspected to be completely fraudulent. Here's how these scams typically unfold: roofers arrive in neighborhoods offering free roof inspections, invariably finding damage and enticing homeowners with promises of a free roof by waiving the insurance deductible. Homeowners unwittingly sign an Assignment of Benefits (AOB), which gives the contractor control over the insurance claim. When the insurance company's adjuster inspects the property, they often find less damage than claimed or none at all. The roofer then sues the insurance company for the full claim amount, leaving the insurance provider with two unfavorable options: either fight the lawsuit and accumulate hefty legal fees or settle out of court. These fraudulent lawsuits have spiraled out of control; in 2021 alone, Florida insurers reported losses of $1.7 billion due to legal costs, and over the last two years, total losses have exceeded $2 billion. This has led many insurance companies to liquidate or exit the state entirely.

Roof Age and Hurricane Risk

Another significant concern in Florida's insurance crisis is the age of roofs. Insurers have become increasingly hesitant to cover homes with older roofs due to the prevalence of these roofing scams. Recent legislative changes have sought to address this issue by prohibiting companies from denying coverage for roofs younger than 15 years old, as long as they have at least five years of life remaining, offering some relief. However, homes with older roofs still face severe challenges in securing insurance. Adding to the situation, Florida's vulnerability to natural disasters extends beyond hurricanes, as evidenced by recent severe weather events, including tornadoes that have further strained the insurance market.

The Creation of Citizens Insurance

As insurers began to flee the state due to the overwhelming costs of covering high-risk areas, a state-funded insurance program called Citizens Property Insurance was created to provide coverage for those unable to secure policies in the private market. Initially, this program offered essential relief, but by 2007, significant legislative changes allowed Citizens to compete directly with private insurers. This shift meant that anyone could obtain coverage through Citizens, resulting in its rapid expansion to cover a substantial percentage of Florida homeowners.

However, by 2022, the situation will grow more complicated. Governor DeSantis expressed a desire to move residents away from reliance on state-funded insurance, a sound theory given that taxpayers ultimately bear the financial burden. Unfortunately, only one private insurer, Slide Insurance, stepped in to fill the void left by departing companies. Despite its dubious reputation, Slide began to cover a significant portion of Florida homes, but with a twist — they could selectively choose which homes to insure. Many considered too risky were left out, and those that were accepted faced premiums that could reach up to 20% higher than those offered by public insurance programs. This shift not only strained homeowners but also impacted the broader real estate market, driving up overall costs and complicating the housing landscape for everyone involved.

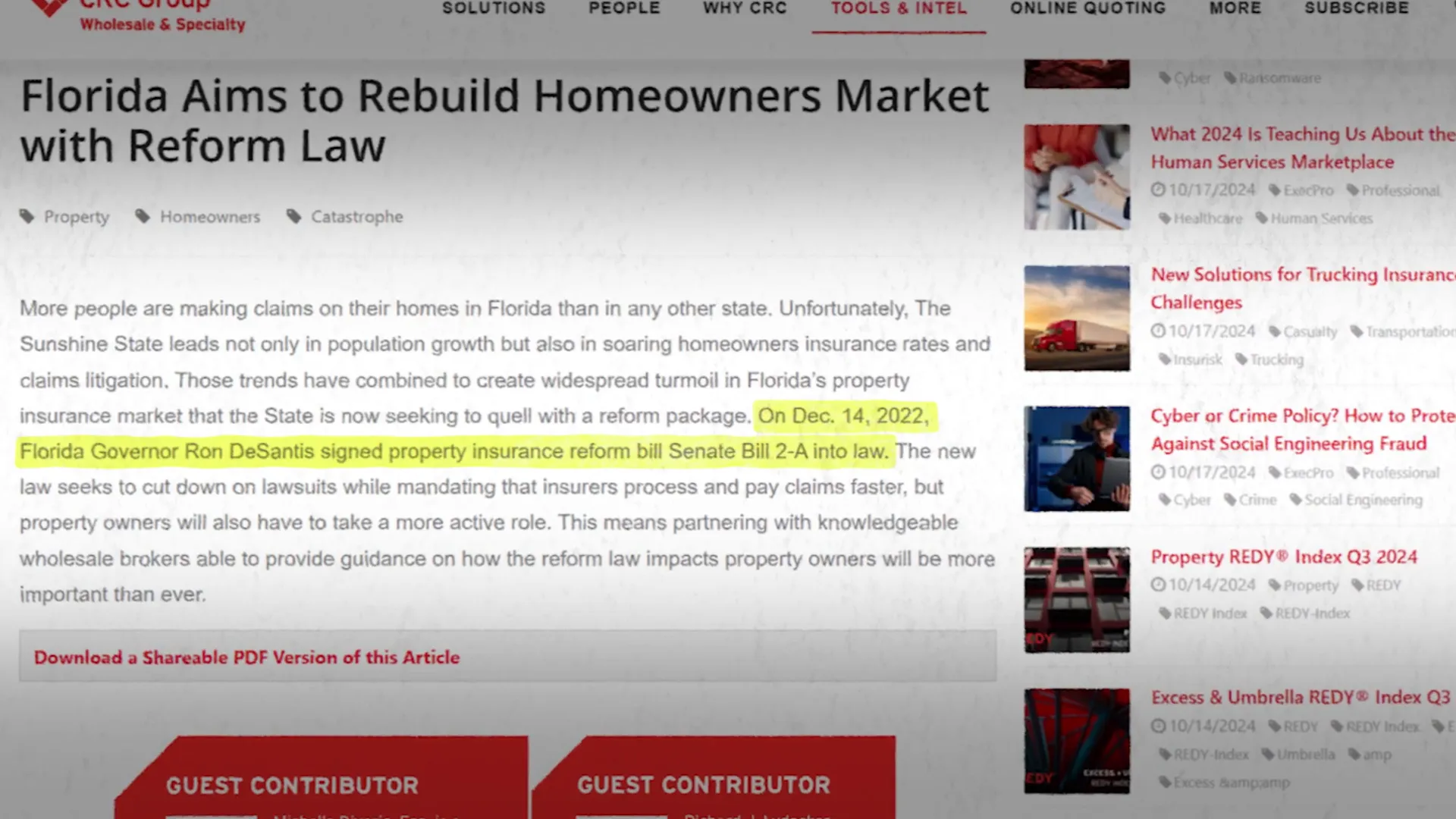

Legislative Reforms: Will They Work?

Recent legislative reforms in Florida aim to address the spiraling insurance crisis, but their effectiveness remains to be seen. The measures introduced in Bill 2A, passed in December 2022, include significant changes designed to stabilize the insurance market. One of the key adjustments is the reduction of the claim filing deadline from two years to one year, which may limit the opportunities for late or fraudulent claims. Additionally, insurers now have just 60 days to pay claims instead of the previous 90 days, creating a more streamlined claims process.

Another critical reform involves the repeal of the one-way attorney fee rule, which previously mandated that insurance companies cover the legal costs of policyholders in lawsuits. This change could deter frivolous lawsuits that have contributed to the financial strain on insurers. Furthermore, the ban on Assignment of Benefits (AOB) agreements aims to curb fraudulent roofing claims by preventing contractors from gaining control over insurance claims, a practice that has burdened many insurers.

While these reforms are a positive step, the long-term impacts on Florida’s insurance landscape are still uncertain. Industry experts caution that it may take time for these changes to yield tangible results in terms of lower premiums and increased availability of coverage. As the market reacts, the question remains: will these legislative reforms be enough to turn the tide in Florida's home insurance crisis?

What Can You Do Right Now?

If your insurance rates are skyrocketing or your policy isn't being renewed, here are a few options:

- Explore your options: Although some companies have left Florida, others have entered the market. Shop around for new policies, as competition could help you secure a better rate.

- Be cautious with Citizens Insurance: While it may seem like a good deal, Citizens' coverage is often limited, and there are concerns about its ability to pay claims in major disasters.

- Protect your home: If you've recently replaced your roof or added storm-resistant features, consider getting a wind mitigation inspection, which could qualify you for discounts on your premiums.

Why Does This Matter For Buyers and Sellers?

The cost of insurance is increasingly impacting the real estate market in Florida. Rising insurance costs are making it difficult for investors to pencil out profitable deals, and locals are finding it harder to choose where to live or invest. Many are even reconsidering whether they want to live in Florida at all.

Insurance costs are expected to keep rising, potentially reaching $8,000 to $12,000 a year, which translates to $1,000 a month just for insurance coverage. This crisis is a significant challenge that could affect your budget and your ability to secure coverage.

Final Thoughts

Florida's insurance crisis is daunting, but steps are being taken to address it. If you're considering moving to Florida or investing in real estate, home insurance should be a top priority. It's a key factor that could impact not just your budget but your overall ability to get coverage. While navigating these challenges may be tough, new options are entering the market, and reforms are underway that could lead to improvements in the future.

FAQ

What is causing the Florida home insurance crisis?

The crisis is largely due to skyrocketing premiums, increased claims related to fraud, and the state’s vulnerability to natural disasters, particularly hurricanes and tornadoes.

How can I find affordable home insurance in Florida?

Explore different insurance options, be cautious with state-funded insurance, and protect your home to qualify for discounts.

What are the recent legislative reforms in Florida's insurance market?

Recent reforms include shortening claim deadlines, reducing payment timelines for insurers, and banning practices that have fueled fraudulent claims.

Is the insurance crisis affecting real estate in Florida?

Yes, rising insurance costs are making it difficult for investors to find profitable deals, and many residents are reconsidering living in Florida due to these challenges.

Ready to navigate Florida's home insurance crisis with confidence? Whether you're buying, selling, or investing in South Florida, the right guidance can make all the difference. At LIV South Florida, we’re here to help you understand the challenges and uncover opportunities in today’s real estate market. Contact us today for expert advice and personalized solutions to secure your dream home in the Sunshine State! Don’t wait—reach out now and take the first step toward a stress-free real estate experience.

Jonathan Alexander creates educational YouTube content to guide potential buyers through the process of relocating to South Florida, offering insights on the best places to live and what to expect. As a seasoned Realtor®, he combines his expertise with a passion for helping clients make informed real estate decisions.